WILLS, TRUSTS & ESTATESMARITAL AGREEMENTSBUSINESS LAW MEDIATION | NOTARYYour trusted Attorney proudly serving individuals, families and business owners across California from our Central Coast Location in Santa Maria and Orcutt.

At Devey Law, we understand that planning for the future can be both emotional and complex. That’s why we provide compassionate, personalized legal representation to help you protect yourself, your loved ones, preserve your legacy, and make confident, informed decisions.

Whether you’re creating a will or trust, building a comprehensive estate plan, preparing a pre- or postnuptial agreement, starting or running a business, completing deed work (such as property transfers or affidavits of death), or in need of mediation or notary services, we provide trusted legal counsel to individuals, families, and business owners across California’s Central Coast.

Built on trust, guided by purpose.

Legal Counsel Rooted inPurpose and Integrity At Devey Law, we’re proud to serve the Central Coast and clients across California with personalized legal counsel in estate planning, probate, and business law.

Devey Law was founded on the belief that everyone deserves access to clear, compassionate, and trustworthy legal counsel.

We offer both in-person and virtual services to make quality legal counsel more accessible — wherever you are. Every client matters here, and we’re committed to helping you protect what’s most important.

- Jamie J. Devey, Attorney at Law

Professional Legal Services. Personalized Attention. Click Here To Book Your Consultation Today.

Client Reviews, Testimonials & Common Experiences

Our ServicesWills, Trusts & Estate Planning

Devey Law helps families create customized wills, trusts, irrevocable trusts and comprehensive estate plans to protect what matters most. Our goal is to make the process simple, clear, and tailored to your unique needs and wishes.

Á La Carte Estate Planning

Devey Law offers à la carte estate planning services for clients who may not need a full plan. Options include a will and trust package, a standalone will, or individual documents such as a power of attorney, advance health care directive, California HIPAA authorization, and guardianship designations for minor children. Every trust we draft includes a pour-over will to ensure your wishes are fully supported.

Amendments, Restatements, Ancillary

Document

Reviews & Updates

Already have an estate plan? Our attorney can review and update your existing plan and related documents—including beneficiary designations, trustee appointments, and incapacity planning tools—to ensure they still reflect your goals and family structure.

Trust Administration

Probate

Devey Law helps guide trustees and loved ones through the legal steps of trust administration and probate with care and clarity. Whether a trust is in place or court involvement is required, we ensure the process is handled efficiently and lawfully.

Business Exit

& Succession Planning

Devey Law helps business owners and families develop comprehensive succession plans that address ownership transfer, management continuity, and family dynamics. Whether you're planning for retirement, incapacity, or unexpected events, we ensure your plan protects both your legacy and your beneficiaries.

Business Law

Devey Law assists entrepreneurs and business owners through every stage of the business lifecycle. From entity formation and startup planning to ongoing operations, restructuring, and succession, we provide strategic legal guidance tailored to your goals. Our services include contract drafting and review, lease agreements, asset purchase and sale agreements, and more. Our goal is to help protect your business and position it for long-term success.

Prenuptial & Postnuptial

Agreements

At Devey Law, we assist individuals and couples with legally sound, thoughtfully crafted marital agreements tailored to their unique relationships and goals. Whether you’re planning a marriage or navigating life changes after marriage, we help protect your interests and clarify expectations. Our services include prenuptial agreements and postnuptial agreements, both designed to promote transparency, preserve assets, and reduce future conflict through clear legal documentation.

Affidavits of Death

& Deed Transfers

At Devey Law, we provide comprehensive legal support for property ownership changes and estate-related real estate matters. Our real property services include preparing and recording deed transfers, assisting with affidavits of death to update title after a property owner passes away, and ensuring your real estate assets are properly aligned with your estate plan.

Professional Legal Counsel. Personalized Attention. Book Your Consultation Today.

To schedule your consultation fill out the form below or contact us: (805) 720-3411 or consultations@deveylaw.com.

We offer both in-person and virtual appointments for your convenience.

At Devey Law, we are committed to providing compassionate and thoughtful legal counsel with integrity, dedication, and personalized service.

Whether you’re planning for the future, forming or operating a business, or managing a legal matter, we are here to help you make informed decisions and protect what matters most.

Located in Santa Maria and Orcutt, California, on the beautiful Central Coast, we proudly serve clients across the entire state. Whether you’re local to the area or anywhere in California, we offer both in-person, mobile and virtual services to meet your needs. Our commitment is to provide exceptional service, no matter where you are.

VIP Estate Planning Service

Our VIP Estate Planning Service offers a streamlined, high-priority experience for clients who want their estate plan finalized within one week.*

Need your estate plan completed quickly? This service includes: priority scheduling, direct access to the attorney, prompt document preparation, and a streamlined process tailored to your schedule.

Whether you're preparing for travel, facing a medical procedure, or simply prefer to handle things efficiently, the VIP option ensures your planning is handled promptly without sacrificing quality or attention to detail.

Availability is limited. Inquire during your consultation or contact us to request VIP scheduling.

*Turnaround time depends on timely client participation and client-retained third-party services (such as notary arrangements).

PRACTICE AREASNavigating the complexities of estate planning can feel overwhelming, but it’s one of the most important steps you can take to protect your assets, your loved ones, and your legacy. Devey Law works closely with clients to create tailored estate plans that ensure peace of mind today and security for tomorrow. Devey Law offers fully integrated and comprehensive services to guide you through each step of the process.

Our role is to provide comprehensive estate planning that safeguards clients' assets—both physical and digital—through meticulous reviews of existing estate plans and individualized strategies, ensuring lasting protection and peace of mind for the future.

Prepare for the unexpected with carefully crafted legal documents that authorize trusted individuals to act on your behalf. At Devey Law, we offer General Durable Powers of Attorney, Advance Health Care Directives, and California HIPAA Authorizations—individually or as a recommended package.

These documents ensure your financial affairs and medical decisions can be managed smoothly if you become incapacitated, providing peace of mind for you and your loved ones.

If you have minor children, naming a legal guardian is one of the most important steps in your estate plan. Devey Law helps parents formally document their wishes under California law—offering peace of mind that your children will be raised by someone you trust.

When a loved one passes, the trust administration process can be complicated and stressful. Devey Law helps families and beneficiaries navigate this with compassion and precision, ensuring that your loved one’s estate is properly administered.

Devey Law guides executors and trustees through every step of the process, including asset management, debt settlement, and distribution to beneficiaries, ensuring compliance with California law while minimizing the burdens placed on you during a challenging time.

Probate can be complex, but you don’t have to go through it alone. Whether you're an executor or a beneficiary, we simplify the probate process, addressing court filings, creditors claims and making court appearances. Our goal is to resolve probate matters efficiently while protecting your rights.

At Devey Law, we understand that running a business comes with complex legal decisions at every stage. That’s why we provide strategic, personalized legal counsel to support you from formation to succession.

Whether you're launching a new company, navigating day-to-day operations and compliance, planning for a smooth business exit, or restructuring your organization for growth, we’re here to guide you with clarity and confidence.

Let Devey Law help you protect what you’ve built and plan for a stronger future.

Ready to Take the Next Step?

Planning for the future doesn’t have to be overwhelming. Whether you need help with a will, trust, probate matter, or business law issue, Devey Law is here to guide you with clarity and compassion.

Request a consultation today to speak with an attorney and take the first step toward peace of mind.

What Sets Us Apart?Navigating estate planning, estate administration, probate or business can be complex, but you don’t have to do it alone. Whether you’re planning for the future, managing a loved one’s legacy, dealing with probate matters, forming or restructuring a business, Devey Law is here to guide you every step of the way.

01

Comprehensive Services.We offer tailored solutions in wills, trusts & estates and business law.

Personalized Service. We take the time to understand your goals and deliver custom legal strategies.

02

Compassionate Approach. We provide legal support with empathy and respect during difficult times.

03

Convenient Access.We offer in-person and virtual consultations throughout California to fit your schedule.

04

Experience.We bring focused experience in estate planning, trust administration & probate, and business law to every client we serve.

05

Clear Communication.We keep you fully informed with clear, straightforward guidance at every stage.

06

Choose Devey Law for legal guidance that’s as professional and reliable as it is personal.

makes legal help easy and accessible with

IN-PERSON and VIRTUAL legal help.

DEVEY LAWDevey Law makes legal support accessible across California. Whether you're based in Santa Maria, Orcutt, California’s Central Coast or elsewhere in the State of California, we’re here to help. Devey Law provides in-person and virtual services for the Central Coast, while offering virtual services to clients across California. Contact Us Today!

Customized, Convenient Support: Whether you prefer meeting face-to-face or connecting online from the comfort of your own home, Devey Law is here to support you on your terms.

In-Person Meetings: For those who value a traditional approach, Devey Law provides in-person meetings at a convenient location of your choice.

Virtual Consultations: If you’re balancing a busy schedule, traveling, or simply prefer virtual communication, Devey Law offers comprehensive online consultations that bring our expertise to you. Secure video conferencing tools ensure privacy and clarity at every step.

Seamless Document Management: Regardless of how we meet, Devey Law utilizes secure, user-friendly digital tools for document preparation, signatures, and sharing, making the process efficient and straightforward.

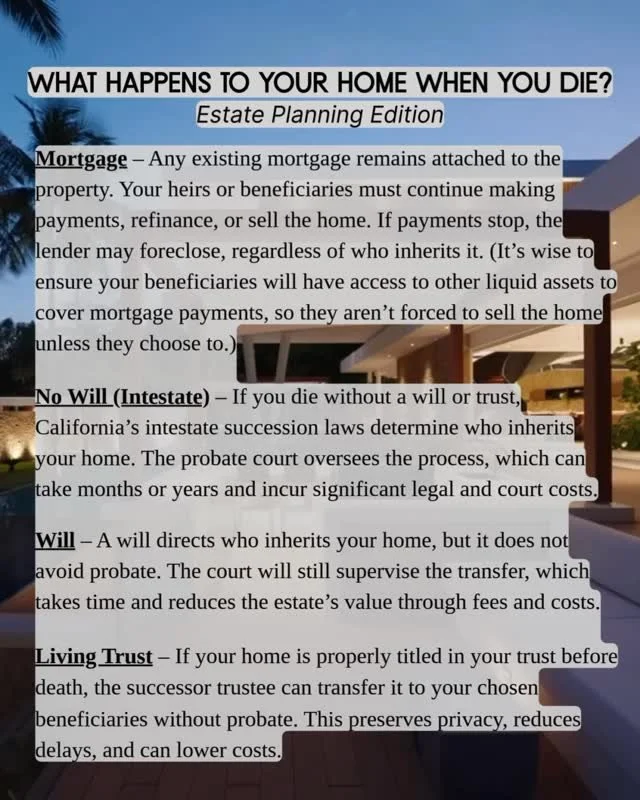

SOCIAL MEDIA

See What We’re Up To On SOCIAL MEDIA.

Stay informed. Follow us on SOCIAL MEDIA.

Devey Law shares practical legal tips, updates on California law, helpful resources, and answers to common questions about estate planning, trust administration & probate, and business law matters AND MORE!

Professional Legal Services. Personalized Attention. Click Here To Book Your Consultation Today.

At The Law Corner, our blog by Devey Law, we break down important legal topics to help you stay informed and empowered. From estate planning tips and probate guidance to updates on California law and answers to common legal questions, our blog is here to give you clear, practical insights. Whether you're planning for your future, navigating a loved one’s estate, or exploring business formation, you'll find helpful resources written with you in mind.

Get quick answers and actionable advice—click any blog topic to learn more.

READ The Law Corner, a DEVEY LAW BlogFAQs

-

Estate planning is the process of organizing your affairs to ensure your assets are distributed according to your wishes, reduce taxes, avoid probate, and designate decision-makers for your medical and financial needs in the event of incapacity. It’s essential for protecting your loved ones, minimizing family disputes, and ensuring peace of mind about the future.

-

A comprehensive estate plan typically includes:

Last Will and Testament: Specifies how your assets will be distributed and appoints guardians for minor children.

Revocable Living Trust: Manages assets during your lifetime and after your death while avoiding probate.

Durable Power of Attorney (Financial): Appoints someone to handle your financial and legal matters if you become incapacitated.

Advance Healthcare Directive: Outlines your medical preferences and appoints a healthcare agent to make decisions on your behalf.

Power of Attorney for Healthcare: Specifically authorizes your chosen agent to make healthcare decisions if you’re unable to do so yourself.

Beneficiary Designations: Assigns beneficiaries for accounts like life insurance policies and retirement accounts.

-

You should review your estate plan every 3–5 years or after major life events, such as:

Marriage or divorce.

Birth or adoption of a child.

Significant changes in your financial situation.

Changes in healthcare preferences or the person you’ve named as your agent.

-

Trust administration is the process of managing and distributing the assets held in a trust after the grantor’s death or during their incapacity. It involves following the instructions outlined in the trust document, complying with legal requirements, and ensuring the beneficiaries receive their inheritances as intended.

-

Failing to administer a trust correctly can lead to legal and financial consequences, including lawsuits from beneficiaries or penalties for unpaid taxes. Trustees can also be held personally liable for breaches of their fiduciary duties.

-

Probate is the legal process of validating a will, settling debts, and distributing a deceased person’s assets. It is typically required if the deceased owned assets solely in their name or if no trust was established to manage those assets.

-

Yes, you can avoid probate by using tools like revocable living trusts, joint ownership of property, and beneficiary designations on accounts like life insurance or retirement funds.

-

Not all estates require probate in California. Probate is typically required if the total value of the deceased's assets exceeds $184,500 (as of 2025) and those assets are not held in a trust or passed directly to beneficiaries via joint ownership or beneficiary designations. However, smaller estates that fall below this threshold may qualify for simplified probate procedures, such as filing an affidavit or small estate declaration. Additionally, assets titled in a trust, payable-on-death accounts, or joint tenancy property can avoid probate altogether.

-

Essential business documents include:

Operating Agreement (for LLCs): Outlines ownership structure, roles, and decision-making processes.

Corporate Bylaws (for Corporations): Governs internal procedures and management.

Power of Attorney: Grants authority for financial or operational decisions in your absence.

Partnership Agreements: Defines roles, contributions, and profit-sharing among partners.

Employee or Independent Contractor Agreements: Clearly outlines expectations and responsibilities.

Client or Vendor Contracts: Ensures clarity and legal protection in business transactions.

-

LLC (Limited Liability Company): Offers flexible management and taxation, and provides personal liability protection.

Corporation: A more formal structure ideal for raising capital, with distinct tax and operational advantages. Corporations can be taxed as C-Corps or S-Corps, depending on their setup.

Deciding between the two depends on your business goals, tax strategy, and operational preferences.

-

Use clear, well-drafted contracts for all transactions.

Establish clear policies and procedures for employees.

Maintain compliance with local, state, and federal laws.

Separate personal and business finances.

Have liability protection in place, such as insurance and a legal business entity (e.g., LLC or corporation).

-

Business agreements and documents should be reviewed annually or whenever a major change occurs, such as:

Bringing on new partners or investors.

Expanding operations or entering new markets.

Changes in state or federal laws that affect your business.